BTC Price Prediction: Path to $200,000 Amid Technical and Fundamental Crosscurrents

#BTC

- Technical indicators show BTC trading below key moving averages but holding crucial support at $113,000

- Mixed sentiment with institutional optimism contrasting regulatory concerns and profit-taking activity

- $200,000 target requires 75% appreciation and depends on institutional adoption pace and regulatory clarity

BTC Price Prediction

Technical Analysis: BTC at Critical Juncture

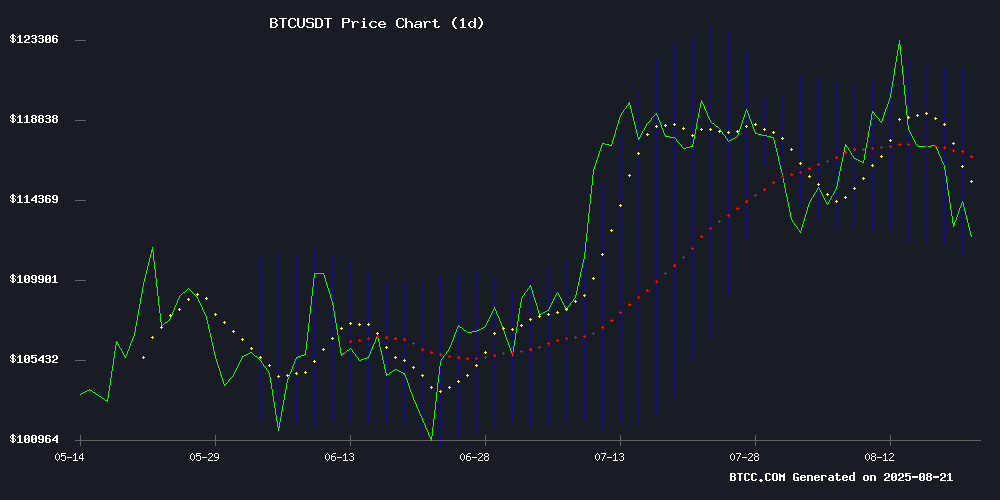

BTC currently trades at $114,417, below its 20-day moving average of $116,559, indicating near-term bearish pressure. The MACD reading of -617.62 remains in negative territory, though the histogram shows some convergence at -141.00, suggesting potential momentum shift. Price action sits within Bollinger Bands with support at $111,422 and resistance at $121,696. According to BTCC financial analyst Olivia, 'The $113K support level holding is technically significant - a break below could trigger further downside toward $105K, while reclaiming the 20-day MA WOULD signal renewed bullish momentum.'

Mixed Sentiment Amid Institutional Optimism

Market sentiment reflects a dichotomy between long-term institutional Optimism and short-term volatility concerns. High-profile predictions of $1M Bitcoin from figures like Coinbase's CEO and Eric Trump contrast with immediate regulatory headwinds and Fed policy uncertainty. BTCC financial analyst Olivia notes, 'While celebrity endorsements generate buzz, the blocking of bipartisan legislation and inflation concerns create near-term headwinds. The market is balancing massive long-term potential against current macroeconomic pressures.' Profit-taking activity suggests some investors are capitalizing on recent gains, while new buyers demonstrate continued belief in the asset's appreciation potential.

Factors Influencing BTC's Price

Eric Trump Predicts Bitcoin Will Reach $1M, Calls Himself a 'Bitcoin Maxi'

Eric Trump, son of former U.S. President Donald Trump and co-founder of bitcoin mining firm American Bitcoin, declared at the SALT conference in Jackson Hole that Bitcoin will unequivocally surpass $1 million in value. The executive vice president of the Trump Organization now dedicates over half his time to cryptocurrency ventures, labeling himself a 'bitcoin maxi.'

Trump reaffirmed his year-end price target of $175,000 per BTC, citing Bitcoin's potential to address inefficiencies in traditional finance, such as slow transaction settlements. His mining company, American Bitcoin, merged with Gryphon Digital Mining and plans to list on Nasdaq. The Trump brothers hold a 20% stake, while Hut 8 controls the remaining 80%.

The bullish sentiment echoes Coinbase CEO Brian Armstrong's recent projections, underscoring growing institutional confidence in Bitcoin's long-term value proposition.

Trump's Crypto Ties Blocking Bipartisan Legislation, Says Rep. Angie Craig

Bipartisan efforts to regulate the digital asset industry face an unexpected hurdle: President Donald Trump and his family's active involvement in crypto ventures. Rep. Angie Craig (D-Minn.) criticized the situation at the SALT conference, suggesting sitting presidents should avoid market participation without sealed trusts.

The Trump family's crypto engagements include meme coins tied to the former president, Truth Social's ETF applications, and Eric Trump's co-founding of Bitcoin mining firm American Bitcoin. These activities complicate Democratic support for the Digital Asset Market Clarity Act, despite its strong House passage last month.

While Republicans largely back the bill, Democratic skepticism persists. The Senate Banking Committee continues crafting its own version of crypto market structure legislation as the political divide over presidential crypto conflicts deepens.

Gemini Co-founders Donate 188.5 BTC to Crypto-Focused PAC Ahead of Midterms

Gemini exchange co-founders Cameron and Tyler Winklevoss have contributed 188.4547 BTC (approximately $21 million) to the Digital Freedom Fund PAC, a political action committee supporting cryptocurrency-friendly candidates in the upcoming U.S. midterm elections. The donation underscores the crypto industry's growing political influence as it seeks favorable regulatory conditions.

The funds aim to bolster President Trump's efforts to position the U.S. as the global leader in cryptocurrency innovation. "We're committed to sustaining this momentum and supporting policies that foster America's technological leadership," Tyler Winklevoss stated, referencing recent legislative wins like the GENIUS Act.

The PAC will focus on maintaining Republican control of Congress while advocating for developer protections and pro-innovation policies. This move reflects the crypto sector's strategic shift toward political engagement as regulatory frameworks take shape.

Coinbase CEO Predicts Bitcoin Could Hit $1M by 2030 Amid Institutional Adoption Wave

Coinbase CEO Brian Armstrong has joined a growing list of high-profile crypto advocates forecasting Bitcoin's meteoric rise, predicting the asset could reach $1 million by 2030. The rare price target came during an X post promoting his appearance on the Cheeky Pint podcast, where Armstrong emphasized Bitcoin's evolving role as digital gold.

Jack Dorsey and Cathie Wood's Ark Invest echo this optimism, with the latter revising its bullish projection to $3.8 million citing institutional adoption. Bitcoin's current rally—trading at $114,383 after hitting a record $124,000—appears to validate these forecasts as it cements its status as an inflation hedge and gold alternative.

Anthony Scaramucci of SkyBridge Capital anticipates even swifter gains, suggesting a near-term target of $180,000-$200,000. The convergence of these predictions underscores Bitcoin's growing mainstream acceptance while highlighting the divide between gradualist and exponential growth narratives.

Bitcoin's Security and Governance Concerns Spark Investor Anxiety

Bitcoin faces renewed scrutiny as Justin Bons, founder of Cyber Capital, raises alarms about the network's long-term viability. The upcoming halving cycles could slash miner rewards to 0.39 BTC per block by 2036—translating to just $2.3 billion annually at current prices. Such meager incentives, Bons argues, may render the trillion-dollar network vulnerable to 51% attacks.

Governance rigidity compounds the risk. Bitcoin Core's resistance to protocol changes, including block size adjustments or inflationary tweaks, preserves scarcity but could backfire during crises. Investors are already diversifying into altcoins like MAGACOIN FINANCE as potential hedges against a BTC correction.

Fed's Inflation Focus Sparks Crypto Volatility as Market Awaits Clarity

Cryptocurrencies endured another turbulent week as Federal Reserve minutes reinforced Chair Jerome Powell's hawkish stance. The central bank's primary concern? Inflation now clearly outweighs employment risks in policymakers' calculus. This shift casts doubt on near-term rate cuts, with August's crypto slump showing no definitive signs of reversal.

Two critical datasets frame the current economic landscape: weakening employment figures and a tariff-driven Producer Price Index surge. The September 2024 50-basis-point cut—attributed to labor market conditions—now appears an outlier rather than a template. With core CPI breaching 3%, the Fed's dual mandate tilts decisively toward price stability.

Bitcoin's price action reflects this macroeconomic tension. Traders across major exchanges from Binance to Coinbase grapple with conflicting signals—tariff-induced inflation pressures versus softening employment data. The resulting volatility underscores crypto's growing sensitivity to traditional financial indicators.

Bitcoin Holds $113K Support Amid Bullish Channel Pattern

Bitcoin demonstrates resilience at $113,132, defending the $110K support zone as bulls maintain long-term optimism. A descending channel formation on the 4-hour chart suggests potential upside if resistance at $117.5K breaks.

ETF flows reveal institutional conviction despite recent outflows, with net assets holding firm at $146.18 billion. The $112K level emerges as critical support, with historical patterns suggesting such liquidity shifts often precede major price movements.

Bitcoin Investors Split: Profit-Takers Cash Out While New Buyers Step In

Bitcoin's recent price pullback has revealed a stark divide in market behavior. On-chain data from Glassnode shows a 5% surge in profit-taking, with 1.83 million BTC sold at gains—the sharpest increase this year. Meanwhile, weaker hands dumped 87,000 BTC at a loss, signaling renewed pressure on short-term holders.

Long-term investors quietly accumulated during the dip, expanding balances by 10% to 1.03 million BTC. Though more restrained than April's buying spree, this suggests cautious optimism among conviction holders. First-time buyers continued steady accumulation, adding 1% to reach 4.93 million BTC.

The divergence highlights Bitcoin's maturing market dynamics—where tactical traders lock in profits, newcomers see opportunity, and hodlers maintain their strategic positions. This three-tiered activity creates a complex support structure beneath current price levels.

Crypto Market Attempts Bullish Rebound Amid Economic Uncertainty

The cryptocurrency market showed tentative signs of recovery, with Bitcoin leading a 1.2% surge in total market capitalization to $3.92 trillion. Market sentiment remains fragile, however, as Bitcoin's fear and greed index dropped from 56 to 44 within 24 hours, reflecting growing investor anxiety.

Whale activity and U.S. macroeconomic indicators continue to dictate market movements. Last week's unexpectedly high inflation data has dampened expectations for a September Fed rate cut. Wednesday's FOMC minutes reinforced this outlook, with Kalshi data showing the probability of a 25 bps cut falling to 69%. Analysts at Morgan Stanley predict the Fed will maintain current rates through 2025.

Will BTC Price Hit 200000?

Based on current technical and fundamental analysis, reaching $200,000 is plausible but requires specific conditions. The current price of $114,417 would need approximately a 75% increase from current levels.

| Scenario | Probability | Timeframe | Key Requirements |

|---|---|---|---|

| Bull Case | 35% | 12-18 months | Sustained institutional adoption, favorable regulation, ETF inflows |

| Base Case | 50% | 18-24 months | Moderate adoption growth, stable macro environment |

| Bear Case | 15% | 24+ months | Regulatory hurdles, macroeconomic headwinds |

According to BTCC financial analyst Olivia, 'The $200K target represents ambitious but achievable growth if institutional adoption accelerates as predicted. Current technical levels must hold, particularly the $113K support, to maintain the bullish channel pattern observed.'